Claim your Next Investors

Ebook today and discover:

10 Lithium Stocks We’ve Invested in for 2023 and Beyond

Find out why we’ve Invested in these 10 lithium stocks.In this detail packed ebook, you’ll get the names of the companies, a summary of our Investment and find out what’s happening with lithium in 2023.You’ll also get a FREE subscription to Next Investors - our newsletter service where we share our takes on the latest news out of the stocks found in this ebook - as well as across a range of other investment thematics.

With over 20+ years of experience Investing in small caps we are a small team of Investors building a high performing ASX small cap stock portfolio and sharing our Investing journey with our readers for free. Simply enter your email address in the box below and click ‘Claim Ebook’.

We will collect and handle your personal information in accordance with our Privacy Policy. We will use your email address only to keep you informed about updates to our portfolio and about our other Investments we think might interest you. Please refer to our Financial Services Guide (FSG) for more information.

You can cancel your subscription at any time.

You’ve heard about its role in batteries. Demand is rising rapidly - meaning companies and governments around the world are racing to find it and ramp up production.

BUT

Where are we Investing?

Find out by downloading the Next Investors' "10 Lithium Stocks We've Invested in for 2023 and beyond" ebook. In this comprehensive guide, you will:

DISCOVER 10 promising lithium stocks that we have personally Invested in.

EXPLORE the future of the lithium market, delve into in-depth analysis, and uncover the potential growth opportunities that lie ahead.

LEARN from our extensive research and insights on the lithium market, giving you the knowledge and confidence to make informed investment decisions.

Claim your copy of this valuable resource today and read our lithium outlook for 2023 and beyond. From lithium explorers, to developers and producers - there’s plenty to learn about and this ebook is a great way to familiarise yourself with some of the fundamental principles of Investing in lithium stocks.

10 Lithium Stocks We’ve Invested in for 2023 and Beyond

This ebook comes with a FREE subscription to Next Investors, we are a small team of investors building a high performing ASX small cap stock portfolio and sharing our Investing journey with our readers for free.

We will collect and handle your personal information in accordance with our Privacy Policy. We will use your email address only to keep you informed about updates to our portfolio and about our other Investments we think might interest you. Please refer to our Financial Services Guide (FSG) for more information.

You can cancel your subscription at any time.

Unleash the Power of Lithium: Why 2024 is the Year for Lithium Stocks

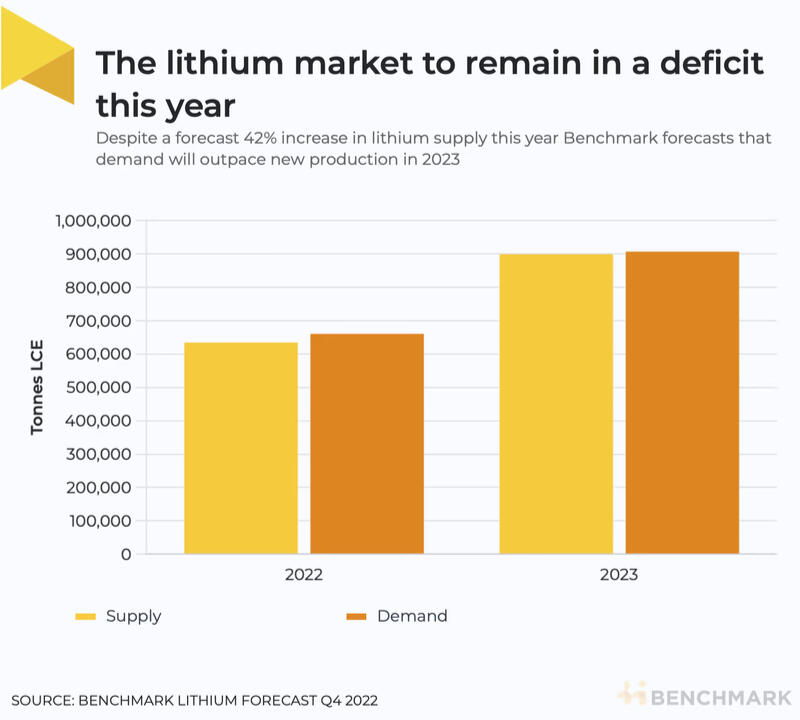

Lithium is a component in virtually all batteries that power electric vehicles (EV) and many consumer electronics that has already seen a sharp rise in demand (and price) over the past five years.New lithium mines are notoriously hard to build and can take ~7-10 years to bring online.In contrast, battery manufacturing capacity can be built in less than 3 years.We think that the supply/demand imbalance in the lithium market comes from this mismatch in ability to come to market with new supply.With lithium demand surging from the billions of $ being invested into battery manufacturing capacity there is a lag in the number of new mines being built.We think that the lithium price will remain high for quite a while longer whilst mining capacity attempts to catch up to demand over the next 5-10 years.We note that while the global economy is forecast to weaken over the coming year, the bullish case for battery metals, including lithium, extends well beyond the short term.And we think this is a decade-long story in which planned lithium supply is well short of projected demand.For some context on the sector’s growth to date, global EV sales caused lithium consumption to double with new production unable to keep up with demand. According to Bloomberg the $ value of the lithium consumed in 2022 was US$35BN, up from US$3BN in 2020.

Who else likes it

Benchmark Mineral IntelligenceBenchmark Minerals, which provides market intelligence for lithium and other battery materials, said demand for the battery material will grow about 40% in 2023 against 2022.Benchmark boss Simon Moores says don’t worry about this short term [lithium price] slip, because the medium-long term outlook is still solid and that it still remains close to all-time highs with demand outstripping supply.Moores said, “Lithium’s medium long term price will keep every resource development project in economic play”. He also notes that a falling price doesn’t necessarily mean a shrinking market and during lithium’s last falling price environment from 2018-2020, the market grew by 30%.

Joe LowryGlobal Lithium LLC founder and lithium expert Joe Lowry expects the price of battery quality lithium carbonate to continue rising into 2027 before hitting highs of US$97,000 per tonne. Lowry identified a base value of just below $US80,000 and a potential 2027 low of around $US70,000. Lowry predicts continued growth into 2035 as the global appetite for lithium-ion batteries continues to feed the new energy revolution.KPMGKPMG says that mining investment is increasingly turning towards lithium, which is still in its infancy. It notes that around 550,000 tonnes of lithium carbonate equivalent was produced in 2022 with that figure forecast to rise to one million tonnes by 2024.Still, at that level, and ignoring other uses of lithium, it would take around 100 years to produce enough lithium to have two billion lithium-ion EVs in service, which is how many EVs that the World Economic Forum says is needed to get to net zero. To achieve that, KPMG says lithium production needs to grow by about 12% per year every year until 2050.Canaccord GenuityAn increase in new lithium supply could take the pressure off, but if producers fail to deliver further price rises are likely, and lithium supply forecasts do have a history of being optimistic. Canaccord’s Reg Spencer makes a compelling case for a near decade long lithium bull run driven in the medium term by the lithium industry’s long history of failing to deliver projects on time to meet demand.IG GroupIG Group said the expected Chinese slowdown (where one in three new cars sold is an EV), is yet to materialise, and “with lithium mines requiring circa 10 years to begin producing, the lithium price could surge yet higher in 2023”.

What about the bear case?

The bear case for lithium is that short term demand pulls back due to a weak global economy, the pandemic, and China’s withdrawal of EV credits, thereby pushing down prices.And on the supply side, if recent record high lithium prices result in new supply coming online faster than expected, the increased supply could place downward pressure on prices.Goldman Sachs expects lithium supply to flip from a 84,000-ton deficit last year to a 76,000-ton surplus, due to demand softening from lower global economic growth combined with higher output. It anticipates prices declining over 2H 2023.Also taking a more bearish short term view is credit ratings agency Fitch, which says that almost all mineral and metal prices will average slightly lower in 2023, with lithium to underperform more than other metals and minerals.And while massive production increases are forecast for 2023, if that is not achieved and supply massively fails to meet the requirements of the battery and EV markets, it would restrict the industry’s expansion plans and global roll out of EVs.

This ebook comes with a FREE subscription to Next Investors, we are a small team of investors building a high performing ASX small cap stock portfolio and sharing our Investing journey with our readers for free.

We will collect and handle your personal information in accordance with our Privacy Policy. We will use your email address only to keep you informed about updates to our portfolio and about our other Investments we think might interest you. Please refer to our Financial Services Guide (FSG) for more information.

You can cancel your subscription at any time.

About Next Investors

We have been Investing in the small cap market for 20+ years. We have made money, lost money, and learned many hard lessons along the way. We are still learning.We use our experience to select and Invest in small cap stocks that we believe have a high chance of success and share our views with our readers.Our MissionTo build a high performing ASX micro cap Investment portfolio and share our research, analysis and Investment strategy with our readers.Our Business ModelOur primary business model is to generate long term returns from our Investment Portfolio.We share our views via our newsletter which is free to subscribe to.In order to keep our newsletter free, we offer an exclusive service to the companies we are Invested in, where we will share our research, analysis and Investment journey in the company with our subscribers.We may charge the companies a fee for this service, which is used to cover our operating costs including of our analysts and writers.This is an exclusive service that we only offer to companies that we are Invested in and have been vetted during our rigorous due diligence process.What do I get as a subscriber?As a subscriber you will be the FIRST to know when we announce a new Investment, and you will get regular, ongoing commentary about the companies in our portfolio, how they are progressing against our Investment Memo and new learnings on the effectiveness of our general Investment strategy.Our Investment Memos help us to track a company's progress against a “Big Bet”, which is our high-level Investment thesis for the company over time.Each week we publish around 3 to 5 articles, one weekend edition, and about 15 Quick Takes which are all publicly available on our website.Our newsletter is free to subscribe.